Government Fiscal Policies and Budget Deficits

Many governments are grappling with rising budget deficits amid persistent inflation and slowing economic growth. The debate about fiscal policy responses – whether to prioritize austerity measures or continued spending to support growth – is ongoing, with significant implications for future economic performance. Reports from national treasuries and international organizations provide analysis of fiscal positions.

The Complexities of Fiscal Policy in Times of Economic Uncertainty

The current economic climate presents a formidable challenge for policymakers. Inflation, driven by factors ranging from supply chain disruptions to increased energy prices, erodes purchasing power and necessitates careful consideration of fiscal interventions. Simultaneously, slowing economic growth threatens job security and overall prosperity, placing pressure on governments to maintain or even increase spending on social programs and infrastructure projects. This creates a delicate balancing act: how to address immediate economic needs without exacerbating long-term fiscal imbalances.

Austerity Measures: The Path of Fiscal Consolidation

Proponents of austerity argue that reducing government spending and raising taxes are necessary to control budget deficits and prevent future economic instability. They point to the potential for high debt levels to crowd out private investment, hindering long-term growth. Austerity measures often involve cuts to public services, reductions in government employment, and increases in taxation. The impact of such policies can be significant, potentially leading to reduced social welfare provision, unemployment, and decreased consumer spending. However, proponents argue that the long-term benefits of fiscal stability outweigh the short-term pain.

Continued Spending: Supporting Growth and Social Welfare

Conversely, advocates for continued government spending emphasize the role of fiscal policy in stimulating economic growth and protecting vulnerable populations. They argue that cutting spending during an economic downturn can deepen the recession, leading to even greater deficits in the long run. Instead, they propose targeted spending on infrastructure projects, education, and social programs to boost aggregate demand, create jobs, and improve living standards. This approach emphasizes the importance of maintaining social safety nets and investing in the future. However, critics caution that increased spending without corresponding revenue increases can lead to unsustainable debt levels and future economic hardship.

Analyzing Fiscal Positions: Data and Interpretation

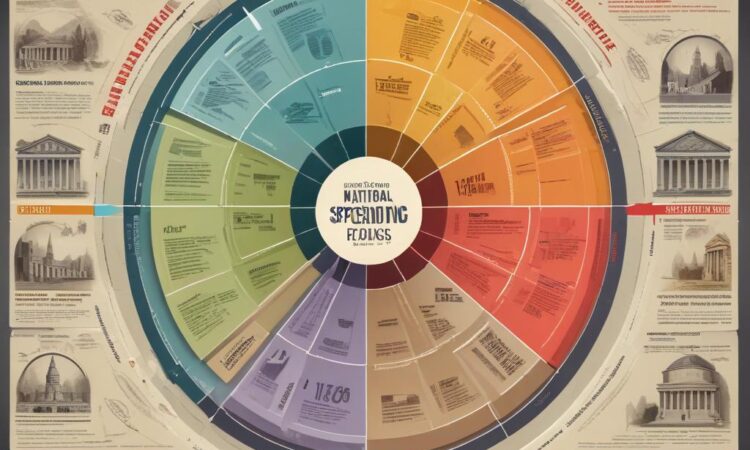

National treasuries and international organizations, such as the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD), play a crucial role in analyzing fiscal positions and providing recommendations for policy adjustments. Their reports offer detailed breakdowns of government revenue, expenditure, and debt levels, allowing for comprehensive assessments of fiscal health. These analyses often incorporate sophisticated econometric models to predict the impact of different policy scenarios, providing valuable insights for policymakers.

The Role of International Organizations

International organizations provide a valuable perspective by comparing fiscal policies across different countries and identifying best practices. Their analysis can help governments learn from each other’s experiences, both successes and failures. They also play a crucial role in providing technical assistance and financial support to countries facing fiscal challenges. This international cooperation is essential in addressing global economic issues and promoting sustainable development.

The Debate Continues: Balancing Short-Term Needs with Long-Term Stability

The debate surrounding the optimal fiscal policy response continues to evolve as the economic landscape shifts. The choice between austerity and continued spending is not a simple one, as both approaches carry potential risks and benefits. Policymakers must carefully weigh the short-term implications of their decisions against the long-term consequences for fiscal sustainability and economic growth. The process requires a nuanced understanding of the complexities of the economy, a commitment to data-driven decision-making, and a willingness to adapt to changing circumstances.

Furthermore, the effectiveness of different fiscal policies can vary significantly depending on a range of factors, including the specific economic context, the structure of the economy, and the institutional capacity of the government. What works in one country may not necessarily work in another. This emphasizes the need for tailored solutions and careful consideration of country-specific circumstances.

The ongoing discussion highlights the crucial role of transparency and public engagement in fiscal policymaking. Open communication about the government’s fiscal position, the rationale behind policy choices, and the potential consequences of different actions can foster public trust and support for difficult decisions. Ultimately, finding a sustainable path requires a collaborative effort involving policymakers, economists, and the public.

The challenge lies in navigating the complex trade-offs between immediate needs and long-term goals. It is a balancing act that demands careful consideration of various factors, including the potential impact on different segments of the population, the effectiveness of different policy instruments, and the overall sustainability of the fiscal path. The decisions made today will have profound implications for future generations.

In conclusion, the issue of government fiscal policies and budget deficits remains a central concern for policymakers worldwide. The ongoing debate reflects the multifaceted nature of the challenge and the need for carefully considered, evidence-based solutions. The path forward requires a commitment to both short-term economic stability and long-term fiscal sustainability. Continued analysis, international cooperation, and transparent communication are essential to navigating these complex economic waters.

This complex situation necessitates ongoing research, analysis, and international cooperation to find effective and sustainable solutions. The future of fiscal policy hinges on a thorough understanding of economic dynamics, informed decision-making, and a commitment to long-term economic stability.

The ongoing dialogue underscores the critical importance of data-driven decision making, the careful consideration of diverse perspectives, and the crucial role of transparent communication in building public trust and support for effective fiscal policies.

Ultimately, the challenge of managing government fiscal policies and budget deficits requires a collaborative, multi-faceted approach that prioritizes both immediate economic needs and long-term fiscal health.

The multifaceted nature of this challenge necessitates a comprehensive understanding of macroeconomic dynamics, insightful policy design, and effective implementation strategies.

The search for optimal fiscal policies remains an ongoing endeavor, requiring continuous adaptation and refinement in light of evolving economic circumstances and societal needs.

The imperative for effective fiscal management underscores the necessity of sound economic governance, transparency, and accountability in the use of public funds.

The ultimate success in managing government finances lies in achieving a delicate balance between immediate economic demands and the long-term sustainability of the nation’s fiscal position.

The path toward sustainable fiscal policies requires a sustained commitment to economic research, informed policymaking, and effective implementation.

Addressing the challenges of government fiscal policies and budget deficits necessitates a comprehensive strategy that incorporates both short-term stabilization measures and long-term structural reforms.

The complexity of the fiscal landscape demands collaboration among policymakers, economists, and the public to foster effective and equitable economic policies.

The effective management of government finances is paramount to ensuring economic stability, social welfare, and sustainable development.