Financial Markets Volatile

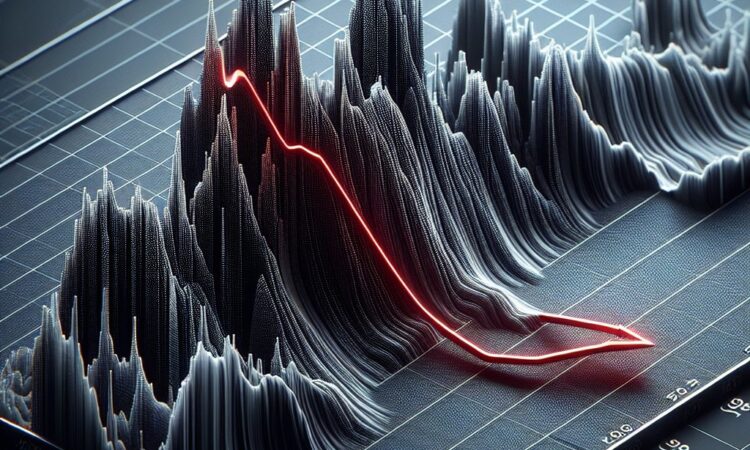

Financial markets have been volatile in recent months, as investors have been concerned about the potential for a global recession and rising interest rates. The S&P 500 index has fallen by over 20% from its peak in January 2023.

What is volatility?

Volatility is a measure of how much the price of an asset fluctuates over time. A higher volatility indicates that the price of the asset is more likely to move up or down sharply, while a lower volatility indicates that the price is more likely to move gradually.

Causes of volatility

There are many factors that can cause volatility in financial markets, including:

* **Economic news:** Economic news releases, such as GDP growth figures and unemployment rates, can have a significant impact on financial markets. Good news tends to boost markets, while bad news tends to weigh on them.* **Interest rates:** Interest rates are another important factor that can affect financial markets. Higher interest rates can make it more expensive for businesses to borrow money and invest, which can lead to slower economic growth and lower stock prices.* **Geopolitical events:** Geopolitical events, such as wars and terrorist attacks, can also cause volatility in financial markets. Investors may become more risk-averse and sell off stocks and other assets in response to such events.

Impact of volatility

Volatility can have a significant impact on investors. Investors who are invested in volatile assets may experience large swings in their portfolio values. This can be stressful and can lead some investors to sell their assets at a loss.

How to manage volatility

There are a number of things that investors can do to manage volatility, including:

* **Diversifying their portfolios:** By investing in a variety of different asset classes, investors can reduce their overall risk. This is because different asset classes tend to perform differently under different market conditions.* **Investing for the long term:** Investors who invest for the long term are less likely to be impacted by short-term volatility. This is because stock markets have historically trended upwards over the long term.* **Using stop-loss orders:** Stop-loss orders can be used to limit the losses on an investment. A stop-loss order is an order to sell an asset if it falls below a certain price.

Conclusion

Volatility is a normal part of financial markets. However, it is important for investors to understand what volatility is and how to manage it. By diversifying their portfolios, investing for the long term, and using stop-loss orders, investors can reduce their risk and protect their investments.