US Labor Market Dynamics and Wage Growth

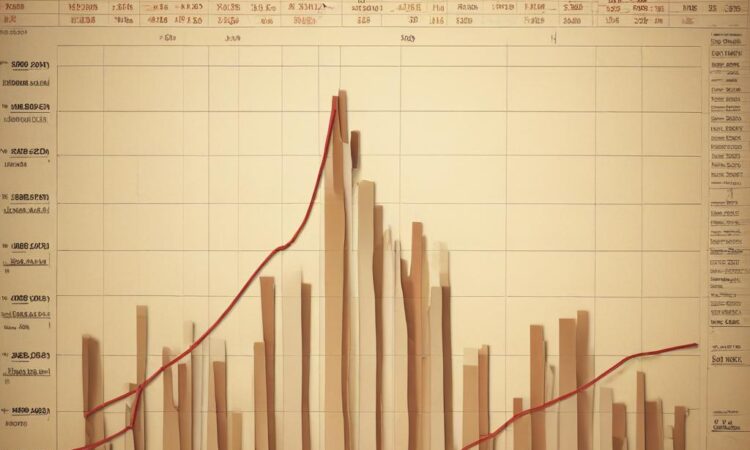

The US labor market remains robust despite concerns about a potential recession. While unemployment remains low, wage growth is a key focus for the Federal Reserve’s monetary policy decisions, as it is a significant factor influencing inflation. Recent employment reports have provided mixed signals, fueling debate about the health of the US economy and the effectiveness of current monetary policy.

The Current State of the Labor Market

The US labor market has shown remarkable resilience in the face of economic uncertainty. Unemployment rates have consistently remained low, often falling below pre-pandemic levels. This low unemployment signifies a strong demand for labor, indicating a healthy economy in many aspects. However, this positive indicator is counterbalanced by rising inflation and concerns about a potential economic downturn.

Several factors contribute to this seemingly paradoxical situation. Firstly, the ongoing recovery from the COVID-19 pandemic continues to drive economic activity. Increased consumer spending and business investments have fueled job creation across numerous sectors. Secondly, demographic shifts, such as an aging workforce and changing labor force participation rates, influence the overall picture. These demographic trends create complexities, making accurate prediction of future labor market dynamics challenging. Finally, technological advancements and automation are reshaping the job market, leading to both job displacement in certain sectors and the creation of new roles in others.

Wage Growth and Inflation

Wage growth has been a significant concern for policymakers. While increased wages benefit workers by improving their purchasing power and living standards, rapid wage growth can also exacerbate inflation if businesses pass these increased labor costs onto consumers in the form of higher prices. This creates a feedback loop where higher prices lead to demands for higher wages, further fueling inflation. This complex interplay between wage growth and inflation makes it a crucial factor for the Federal Reserve’s monetary policy decisions.

The Federal Reserve aims to maintain a stable price level and full employment. To achieve these dual mandates, the central bank utilizes various monetary policy tools, including interest rate adjustments. By raising interest rates, the Fed attempts to cool down the economy, curbing inflation by reducing borrowing and investment. However, increasing interest rates also carries the risk of slowing economic growth, potentially leading to job losses and a recession. The challenge lies in finding the right balance – controlling inflation without triggering a significant economic downturn.

Recent Employment Reports and Their Interpretations

Recent employment reports have painted a mixed picture, adding to the uncertainty surrounding the US economy’s trajectory. While some reports have shown robust job growth, others have indicated a slowdown in hiring. This inconsistency makes it difficult for economists and policymakers to reach a consensus on the true health of the labor market. The discrepancy between reported job growth and other economic indicators, such as consumer spending and business investment, further complicates the analysis.

Several factors contribute to the mixed signals. Seasonal adjustments, methodological changes in data collection, and the inherent volatility of economic data can all influence the interpretation of employment reports. Furthermore, the ongoing impact of the COVID-19 pandemic and geopolitical uncertainties, such as the war in Ukraine and supply chain disruptions, continue to create economic instability and add to the complexity of interpreting the data.

The Debate on Monetary Policy Effectiveness

The mixed signals from the labor market and the ongoing debate on the effectiveness of current monetary policy highlight the challenges faced by policymakers. Some argue that the Federal Reserve’s aggressive interest rate hikes are already having the desired effect on inflation, while others maintain that the measures haven’t been sufficient and that further action is needed. This divergence in views reflects the complexity of the economic situation and the inherent uncertainties involved in forecasting future economic trends.

The debate extends beyond the effectiveness of interest rate adjustments. Concerns about the potential impact of monetary policy on different segments of the population add another layer of complexity. For example, higher interest rates can disproportionately affect lower-income households, as they may have limited access to credit and face increased borrowing costs for essential expenses. This consideration underscores the need for a nuanced approach to monetary policy, carefully weighing the benefits and risks for different segments of the economy.

Looking Ahead: Challenges and Uncertainties

The future of the US labor market and the effectiveness of current monetary policy remain uncertain. Several challenges lie ahead, including the potential for a recession, persistent inflation, and evolving demographic trends. The ongoing geopolitical instability further adds to the uncertainty. Predicting the trajectory of the US economy requires considering a wide range of factors, many of which are interconnected and difficult to model accurately.

Policymakers face the difficult task of navigating these uncertainties while striving to achieve their dual mandates of price stability and full employment. Finding the right balance between curbing inflation and preventing a recession is a delicate act, requiring careful consideration of the potential short-term and long-term consequences of different policy options. The coming months and years will likely witness continued debate and adjustments to economic policies as policymakers respond to the evolving dynamics of the US labor market and the overall economy.

The ongoing analysis and debate surrounding the US labor market and wage growth emphasize the intricate interplay between various economic factors and the challenges policymakers face in managing a complex and ever-changing economic landscape. The situation requires ongoing monitoring, adaptation, and a willingness to adjust strategies as new data emerges and economic conditions evolve.

Further research and analysis are crucial to better understand the underlying dynamics of the labor market and to inform the development of effective economic policies. A deeper understanding of the interplay between wage growth, inflation, and monetary policy is essential for ensuring a stable and prosperous economy.

The complexities of the current economic climate underscore the importance of continuous monitoring and rigorous analysis of economic data. Only through such careful study can policymakers hope to make informed decisions that promote sustainable economic growth and protect the well-being of all citizens.

The current economic situation necessitates a proactive and adaptive approach from policymakers, businesses, and individuals alike. Flexibility, innovation, and collaboration are essential to navigate the challenges and opportunities that lie ahead.

In conclusion, the US labor market’s current state is a complex issue with many interconnected elements. The ongoing debate surrounding wage growth and monetary policy reflects the inherent challenges in managing a dynamic and unpredictable economy. Continuous monitoring, adaptation, and a willingness to adjust strategies will be key to navigating the future.

Further research and data analysis are essential for a more comprehensive understanding of the intricate dynamics at play.

This situation underscores the importance of careful consideration and well-informed decision-making in navigating these economic uncertainties.

The complexities of this economic landscape necessitate a comprehensive and multifaceted approach to address the challenges and opportunities presented.

The ongoing developments and their implications require continued observation and analysis.

The need for a robust and adaptable economic strategy cannot be overstated.

The future of the US economy depends on a well-informed and proactive approach to these complex challenges.

Continued monitoring and rigorous analysis are essential for effective economic management.

The situation requires a balanced and nuanced approach, considering the short-term and long-term implications of various policy options.