Central Bank Policy Divergence

Central banks around the world are adopting different approaches to monetary policy. The US Federal Reserve, for instance, has been raising interest rates aggressively to fight inflation, whereas the Bank of Japan has chosen to keep rates low to support economic growth.

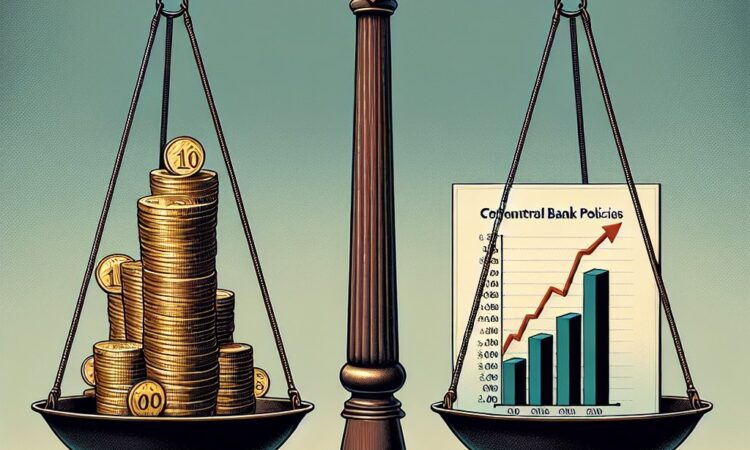

This divergence in central bank policies can be visualized through an image. The image features a set of weighing scales, each side representing a different central bank approach. On one side of the scale, it tilts downwards, symbolizing the central bank’s aggressive interest rate hikes. A stack of coins labeled ‘Inflation’ represents the need to combat rising inflation. On the other side of the scale, it tilts upwards, indicating a different approach taken by another central bank. A graph depicting economic growth represents the decision to keep interest rates low, enabling economic expansion.

The image aims to portray the metaphorical contrast between the approaches of central banks worldwide. Each side represents a response to the unique economic conditions faced by different countries. The tilted scales demonstrate how divergent policies can have significant impacts on a nation’s economy and the global financial landscape.

Understanding central bank policy divergence is crucial for investors, economists, and policymakers as it helps to anticipate economic trends and make informed decisions. The image, through its visual representation, elicits a deeper understanding of the concept and its implications.